Difference between assets and liabilities

Assets are valuable items you own, such as your home, car, funds, or investments. It increases your financial situation by raising your net worth. Liabilities, on the other hand, are financial obligations or debts, such as mortgages, loans, or credit card bills, that indicate money owed to others. While assets increase your financial power, liabilities decrease it, and understanding this distinction is vital for effective personal finance management.

In short

What are assets?

Assets are valuable possessions or resources that an individual, company, or organization owns and controls, contributing positively to their overall financial worth.

Examples of assets include properties, investments, cash, and other items with monetary value.

What are liabilities?

Liabilities are financial obligations or debts that an individual, company, or organization owes to others. These are the sums of money or resources that must be paid back or fulfilled in the future.

Examples of liabilities include loans, mortgages, credit card balances, and other financial commitments.

Assets vs. liabilities

| Assets | Liabilities | |

|

Meaning

|

Valuable resources owned by an entity | Financial obligations or debts of an entity |

|

Description

|

Adds positive value to the entity | Represents obligations that subtract from worth |

|

Type

|

Tangible (e.g., property, cash) and Intangible (e.g., patents, trademarks) | Short-term (e.g., loans) and long-term (e.g., mortgages) |

|

Cash Flow

|

Can generate positive cash inflow (e.g., dividends, interest) | Often associated with cash outflow (e.g., loan repayments) |

Examples of assets and liabilities

Asset

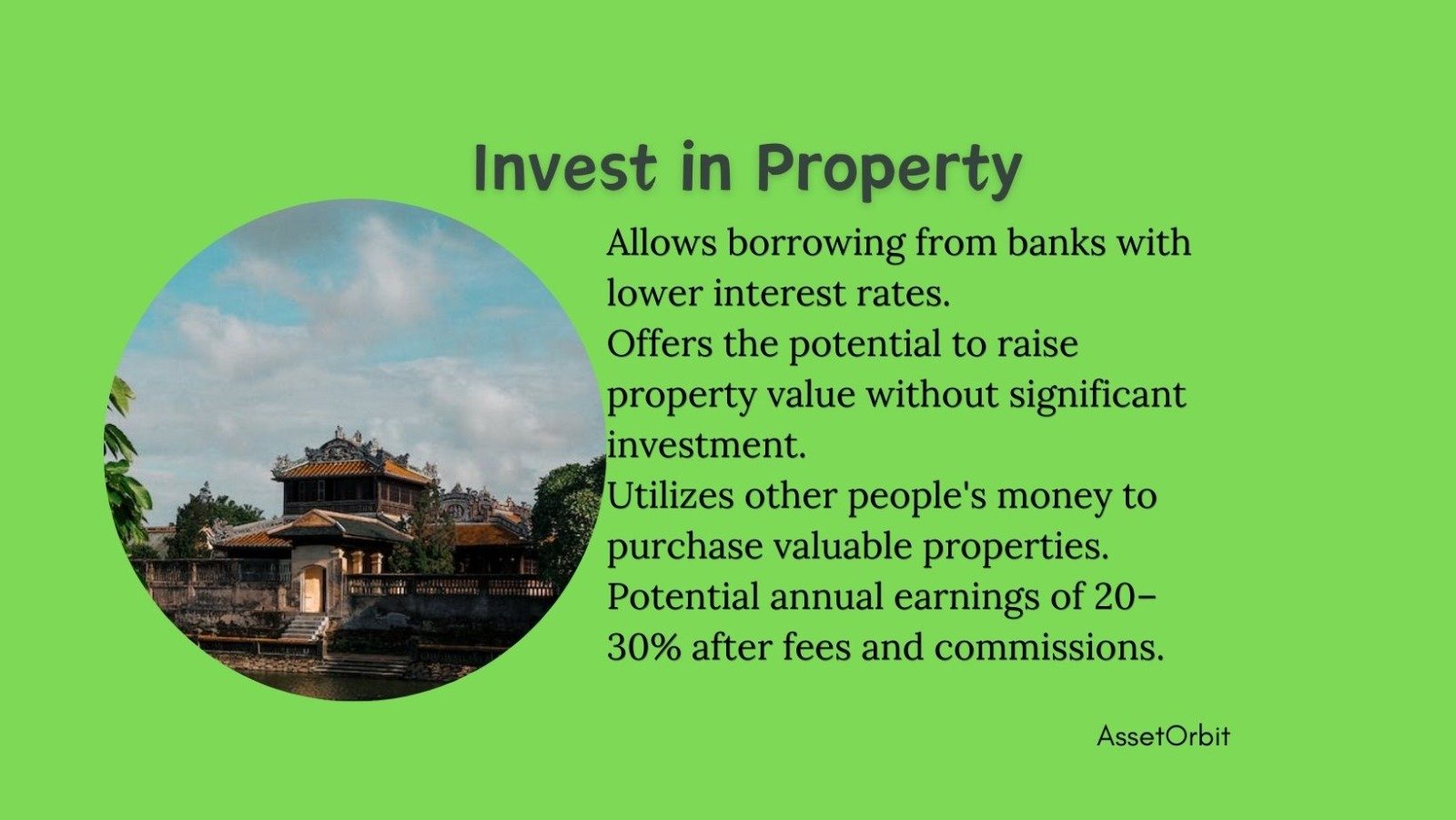

Suppose you have purchased a property as a long-term investment. The property’s worth may rise over time, making it a valuable asset for you. You can even make money by renting it out. This property, which is considered a significant asset, has the potential to provide passive income. Keep in mind, however, that if you buy the property for personal use, carrying maintenance and other expenditures, it may become a problem.

Liability

On the other hand, if you buy a car for personal use, it may be deemed a liability. While it provides convenience and transportation, it does not generate money and incurs constant expenses such as fuel, maintenance, and insurance. In this situation, the car is more of a liability because it does not contribute to passive revenue and necessitates ongoing expenses.

Assets, liabilities and passive income

To increase passive income, it is essential to prioritize assets over liabilities. Assets are precious resources that can provide revenue over time. Investing in stocks, real estate, or creating content that produces royalties, for example, can all be considered assets. These assets have the potential to contribute to passive income streams, allowing you to make money without always being engaged.

On the other hand, liabilities, such as personal expenses or items that don’t generate income, typically don’t contribute to passive income growth. Prioritizing investments in assets with the potential to gain or create regular income is critical to establishing a long-term passive income stream. Individuals can work towards financial goals and generate prospects for income growth by focusing on assets rather than depending primarily on active efforts.

Final thoughts

Understanding the difference between assets and liabilities is crucial for making informed financial decisions. Assets, such as tangible assets like property and intangible investments, enhance an entity’s worth and generate income. Liabilities, on the other hand, are financial obligations or debts that subtract from an entity’s worth, such as loan repayments or credit card balances. This helps individuals and businesses strategize effectively, prioritizing asset growth for long-term financial well-being and responsibly managing liabilities. Leveraging assets to build wealth leads to a robust and sustainable financial foundation.

FAQs

What is the difference between current assets and liabilities?

Current assets and liabilities are distinct financial concepts. Current assets are resources a company expects to convert into cash or use up within a year or operating cycle, such as cash, accounts receivable, and inventory. On the other hand, current liabilities are obligations that a company expects to settle within a year, such as accounts payable, short-term loans, and accrued expenses. These assets are expected to provide future economic benefits, while liabilities are obligations that need to be settled in the near term.