Financial literacy involves understanding and using financial skills like budgeting, investing, and money management. It involves making informed decisions, navigating finances, and planning for future goals.

In Short

What Is Financial Literacy?

Financial literacy is the capacity to understand and use various financial skills, such as budgeting, investing, and money management. It includes knowing how to make informed and successful financial decisions, navigating the intricacies of personal finances, and planning for future financial goals. A financially literate person is prepared to handle day-to-day financial activities, make strategic financial decisions, and create a safe and sustainable financial future.

Key Points of Financial Literacy

- Budget creation and expense tracking

- Establishing Savings Plans for Emergencies and Future Goals

- Responsible Credit Use and Strategic Debt Reduction

- Understanding investment principles and making informed decisions

- Knowledge of various financial products and making informed choices

- Balancing risk and return in financial decisions

- Planning for a secure retirement through consistent contributions

- Understanding basic tax principles and obligations

- Informed consumer behavior and protection against financial scams

- Creating plans for asset distribution and understanding wills and beneficiaries

- Improving Financial Literacy through Education

Way to Financial Literacy

Starting the journey towards financial literacy is akin to gaining access to a secure and empowered future. In this guide, we’ll go over the key steps and practical advice that will help you master your money and achieve financial well-being. Let’s travel the road to financial literacy together!

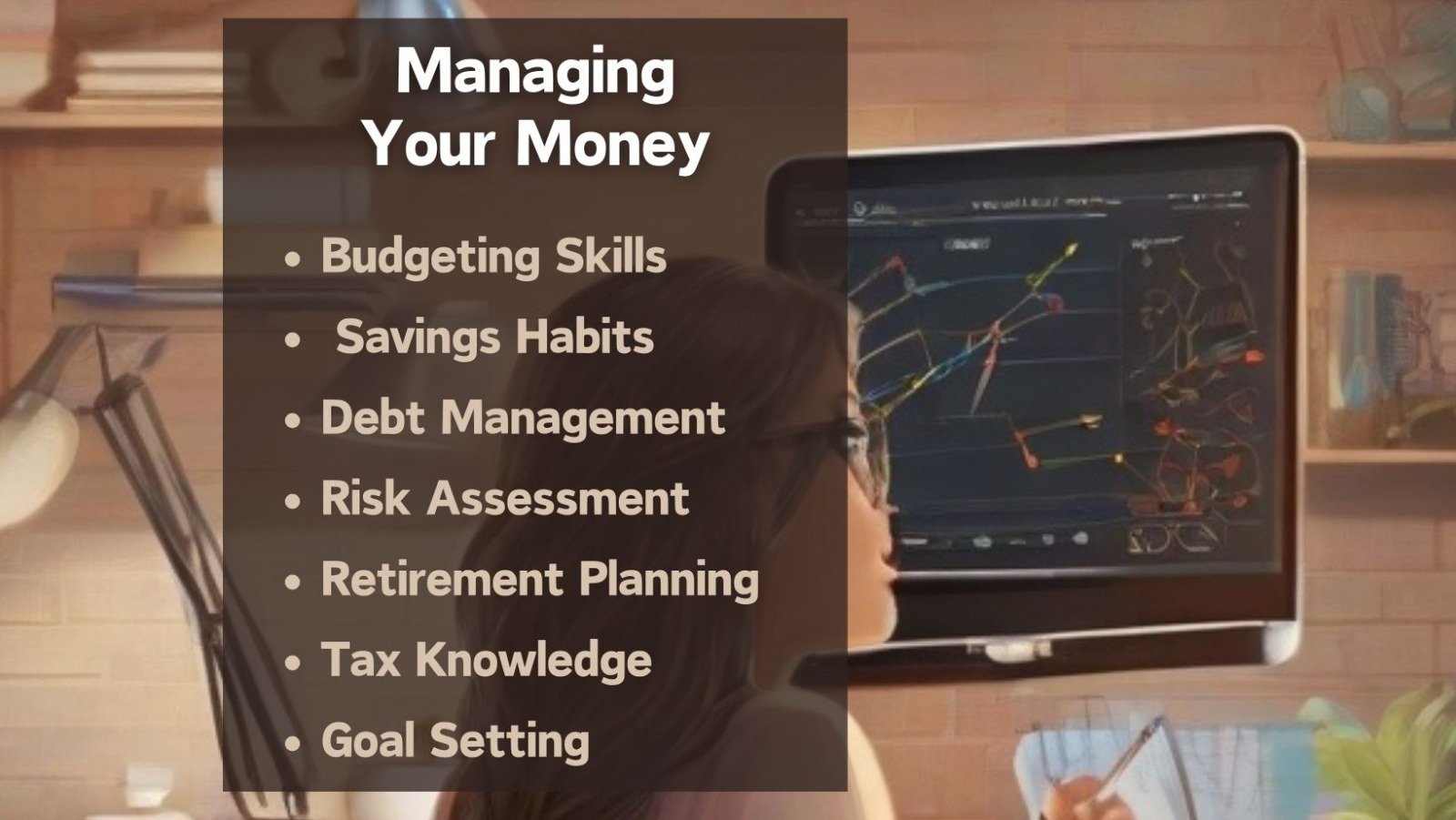

Guide to managing your money

1. Budgeting Skills

A budget functions as a roadmap, guiding your financial management by outlining your income and outlining your intended spending. Recording your income and expenses gives you control over your financial path, ensuring that your money aligns with your priorities and goals. Let’s begin with budgeting, as it serves as a valuable tool for making informed and thoughtful financial decisions.

Understanding where your money goes gives you useful insights into your financial patterns and allows you to find potential savings areas. Tracking your spending habits allows you to make more educated decisions, prioritize your expenses, and work toward your financial goals. It’s a simple yet effective strategy that helps you establish a firm basis for financial well-being.

2. Education and Awareness

Learning about financial concepts, tools, and resources is like arming yourself with a powerful toolkit for managing the financial world. It entails learning vocabulary, investigating financial tools, and discovering resources that will enable you to make informed financial decisions.

Furthermore, staying educated about economic trends and financial news is like having a compass that steers you through the volatile financial terrain. It enables you to be aware of developments, predict potential consequences for your financial condition, and adjust your strategy accordingly. Gaining knowledge and staying informed are essential for establishing financial confidence and success.

3. Savings Habits

Developing the practice of saving money on a regular basis is essential for financial stability. It’s akin to planting the foundation for a secure financial future. Consistently setting aside a portion of your income allows you to build a financial buffer for unexpected expenses and establish the foundation for achieving your long-term goals. Cultivating this saving habit creates a sense of security and allows you to take control of your financial journey, ensuring that you have resources available when you need them the most.

Saving money away for emergencies and long-term financial goals is analogous to sowing seeds for a secure future. By saving proactively, you create a safety net to help you handle unforeseen problems and pave the path for you to achieve your goals. It’s a simple but effective strategy that promotes financial stability and opens the way to a more secure and happier future.

4. Debt Management

Developing techniques for ethical credit use is an important element of financial literacy. It entails learning the ins and outs of credit, such as handling credit cards properly, making regular payments, and maintaining a healthy credit score. By implementing these tactics, you will not only be able to develop a positive credit history, but you will also ensure that credit is used as a helpful tool rather than a financial burden. It is about using credit to meet your financial goals and improve your overall financial health.

Strategies include prioritizing high-interest bills, creating realistic repayment schedules, and combining debts for manageable installments. This method helps make informed decisions, reduce financial stress, and work towards a debt-free future, laying a solid foundation for financial independence.

5. Investment Basics

Understanding various investment opportunities is akin to unlocking the path to potential financial success. It entails studying numerous channels, such as stocks, ETFs, bonds, and mutual funds, as well as estimating their risks and rewards. By learning this knowledge, you will be able to make informed investing decisions that are in line with your financial objectives. Understanding different investment possibilities is a vital step toward building a varied and balanced investment portfolio, whether you’re aiming for long-term wealth growth or short-term rewards.

Comprehending the basics of risk and return in investing decisions is analogous to comprehending the delicate balance between opportunity and prudence in the financial world. It entails understanding that bigger potential returns frequently come with higher risk, and vice versa. By understanding these principles, you will be able to make investment decisions that are in line with your risk tolerance and financial objectives.

6. Financial Products Understanding

Understanding various financial products like insurance and retirement plans is crucial for financial well-being. It involves understanding the nuances of each product and making informed decisions that align with individual needs. This knowledge empowers individuals to navigate the financial landscape confidently, making choices that best suit their unique circumstances.

7. Risk Assessment

Navigating the financial landscape effectively entails assessing and managing the risks associated with various decisions. This method includes a careful examination of individual risk tolerance, ensuring that investment selections correspond to one’s level of comfort. Individuals can make informed financial decisions that reflect their specific circumstances and contribute to a resilient and well-managed financial portfolio by striking a balance between risk and caution.

8. Retirement Planning

Planning for a financially secure retirement requires a twofold focus: understanding retirement account alternatives and making educated contributions. It’s similar to making a plan for a comfortable future. Individuals can provide a solid foundation for their post-work years by understanding the various retirement accounts and contributing strategically. This proactive strategy ensures a well-planned and secure retirement by balancing financial goals with the measures required for a joyful and fulfilling life after work.

9. Tax Knowledge

It involves understanding tax regulations, filing requirements, and obligations. This knowledge allows individuals to identify tax optimization opportunities, such as using deductions or credits to minimize liabilities. Combining tax fundamentals with proactive optimization helps individuals navigate the tax landscape effectively and make informed financial decisions.

10. Goal Setting

Setting detailed and attainable financial goals is similar to charting a clear path for your financial journey. It entails specifying specific goals, such as saving for a dream vacation, purchasing a home, or establishing an emergency fund. Setting defined goals gives direction to your financial efforts and creates a road map for achievement. These objectives should be reachable and practical, allowing you to celebrate milestones along the way and stay motivated on your journey to financial well-being.

Making a plan to achieve short-term and long-term goals is similar to mapping a road to financial success. Outlining actionable steps and tactics targeted at specific goals is required. A well-crafted plan gives a road map for achieving short-term or long-term goals such as housing or retirement. This proactive strategy not only clarifies your financial journey, but it also increases the possibility of achieving your goals by breaking them down into achievable chunks.

11. Continuous Learning

Continual financial education and staying updated on industry changes are crucial for financial empowerment. It involves expanding financial knowledge, understanding industry trends, and adapting financial strategies. This knowledge helps individuals make informed decisions and navigate the financial world confidently. Embracing this commitment builds resilience and promotes a proactive approach to financial well-being.

To live a fulfilled life, it is essential to plan ahead, budget effectively, monitor cash flow, invest wisely, take calculated risks, save for retirement, pay taxes, manage debt, be prepared for emergencies, protect wealth from inflation, and enjoy life. Read more…

Final Thoughts

Finally, The Easiest Way to Financial Literacy: A Guide to Managing Your Money offers an empowering look at the practical steps to financial well-being. People can control their finances by budgeting, saving, and investing. We stressed debt recognition and management, financial goals, and economic trends. Let this book guide you to financial literacy and empowerment, where informed choices lead to a more secure and joyful financial future. Remember that true financial literacy requires ongoing study and application to your specific financial situation.

FAQ

How can I improve my finance skills?

Begin by educating yourself by reading credible sources and enrolling in online courses. Make a precise budget to better understand your financial inputs and expenditures, and prioritize saving for unforeseen needs. Familiarize yourself with various investment possibilities and debt management tactics, and develop clear financial goals with detailed plans to accomplish them. Stay up-to-date on financial news and use technology to your advantage with financial tools. Review and change your financial strategy on a regular basis, learning from both triumphs and failures to consistently improve your financial skills and make educated decisions for your financial well-being.

What is basic financial literacy?

Basic financial literacy refers to a fundamental understanding of key financial ideas and abilities required to make informed and effective financial decisions. It includes an understanding of budgeting, saving, investing, debt management, and long-term financial planning. A financially educated person can build and maintain a budget, make informed decisions about financial products, understand the fundamentals of investing, and overcome typical financial issues. Basic financial literacy is essential for establishing a secure financial future and making sensible financial decisions in everyday life.

Leave a Reply