Smart money is managed by knowledgeable investors, usually insiders or institutions, who make strategic investment decisions after extensive research. While it can boost profits, it doesn’t guarantee success.

Smart money refers to funds managed by experienced, knowledgeable investors, often considered insiders or institutional entities. These smart money investors possess sophisticated market insights and make strategic investment decisions based on extensive research and analysis.

Smart money investors engage in informed and strategic investment practices, contrasting with retail investors, who may lack the same level of expertise.

Smart Money Concepts

Intelligent investors do thorough market research before making any financial decisions. Investors seeking to understand market trends and opportunities should seek guidance from savvy investors.

What is an Example of Smart Money?

A hedge fund with a strong track record, whose skilled fund managers apply complex strategies based on in-depth study and analysis, is an example of smart money. These specialists may have proprietary market information and insights that enable them to make smart investment decisions. Investors frequently analyze the conduct of institutional companies because they are viewed as making wise financial market judgments.

What is Smart Money in Trading?

Smart money refers to funds controlled by experienced and informed investors with a deep understanding of the market. These investors, often institutional entities, hedge funds, or high-net-worth individuals, make strategic decisions based on comprehensive analysis. Other traders and investors closely monitor their actions, gaining insights into potential market trends. Smart money’s movements are considered influential in investment decisions.

Is Smart Money Concept Profitable?

Smart money, a strategy involving well-researched and strategic investments, can lead to increased profitability, but it’s not a guarantee of success in every investment, as market conditions, geopolitical events, and unexpected market movements can significantly impact the profitability of any investment strategy.

Smart money refers to successful investment decisions made by knowledgeable investors, but individual investors should conduct their own research, assess risk tolerance, and consider financial goals before making decisions. Following institutional investors or experienced fund managers doesn’t guarantee profitability, so they should approach the market with a well-thought-out strategy.

How to Track Money in Smart Money Movement?

Tracking smart money involves monitoring the actions and decisions of institutional investors, fund managers, and other financial market participants using various strategies.

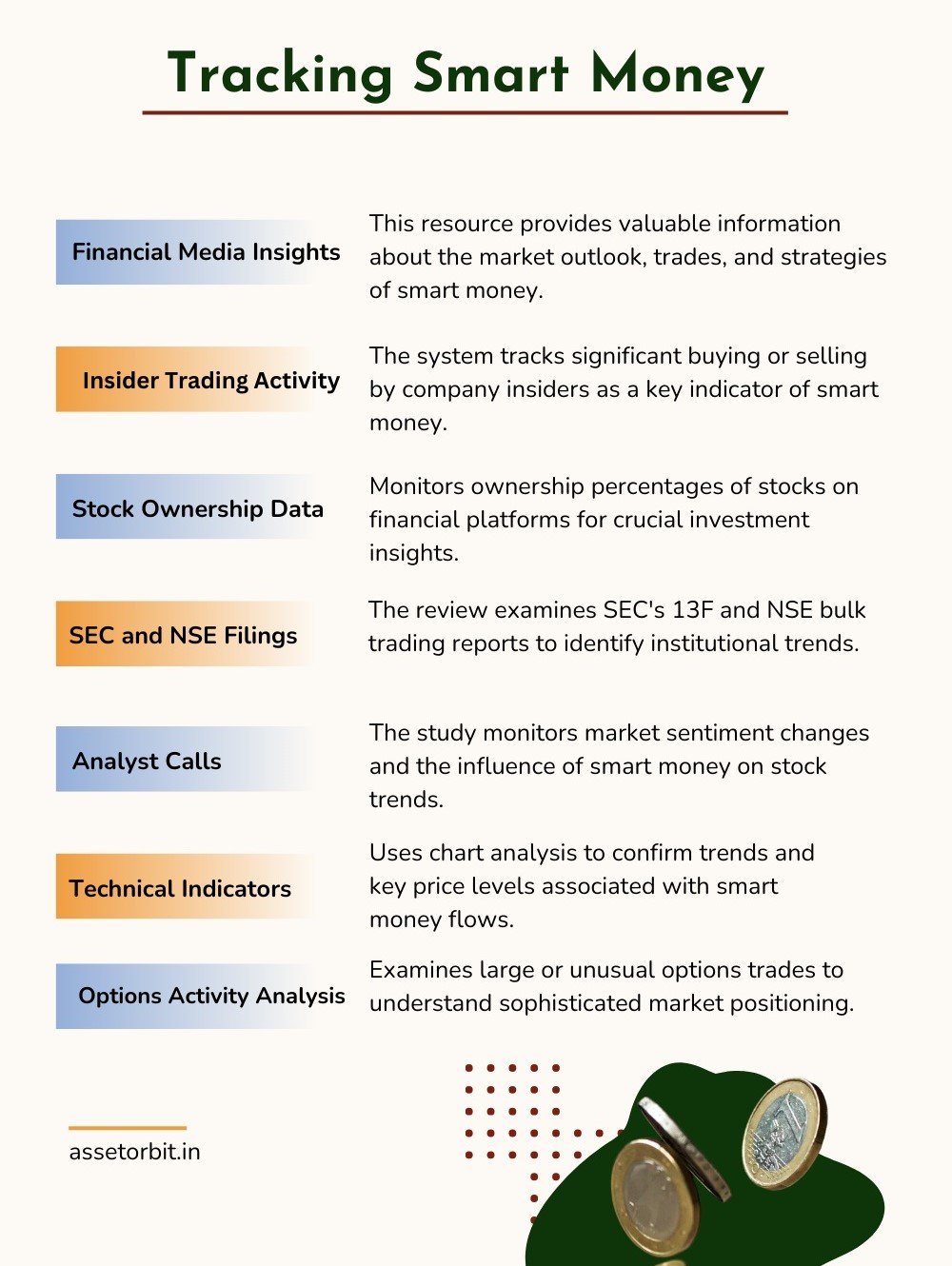

8 Ways to Track Smart Money

- Financial media provides valuable insights into market outlook, highlighting significant trades and investment strategies, ensuring informed investment decisions and smart money movements.

- Insider activity in companies is often characterized by smart money movements, with significant buying or selling being a notable aspect of this trading activity.

- Various financial websites and platforms track the ownership percentage of a stock, which plays a crucial role.

- Explore securities by reviewing SEC filings, including 13F filings, that reveal institutional holdings and large investor positions and provide valuable insights. In India, the NSE bulk trading report indicates the smart money movements.

- Analyst calls reveal market sentiment changes, indicating the potential impact of smart money on the market.

- Technical indicators offer additional confirmation in identifying trends and significant price levels through a thorough analysis of charts.

- The analysis of options activity, particularly large or unusual trades, can reveal sophisticated investors’ market positioning.

- Financial forums and social media platforms are valuable resources for staying informed about market movements, but it’s crucial to verify information from reliable sources.

Final Thoughts

Remember that tracking smart money movements is not ideal, and individual investors should perform rigorous research, evaluate their personal financial goals and risk tolerance, and utilize smart money insights as one of several elements in their decision-making process. Furthermore, because regulatory filings and reports are typically trailing indicators, timely and accurate data is critical for successful tracking.

Leave a Reply