This article outlines the top 9 multibagger stocks to buy for 2024 in India, focusing on stocks with potential for significant growth. The selection of these stocks is influenced by technical analysis and exponential growth potential. Understanding these factors helps investors make informed decisions and navigate the unpredictable world of stocks, aiming to stay ahead of the curve and achieve financial success in the Indian stock market.

In Short

Balancing Risk Reward Ratio

The risk-reward ratio is a key factor in selecting the best multibagger stocks, requiring careful assessment and management of risks, considering factors like market volatility, industry trends, and financial stability. Aligning a strategic approach with individual financial goals helps investors navigate market complexities and optimize their portfolios for long-term success.

Which Is the Best Multibagger Stocks to Buy Now?

The in-depth study of the Best 9 Stocks for the Future guide digs into the distinct growth potential given by each featured company, which includes…

This study uses Elliott Wave analysis to help investors understand possible market changes and shows where each stock fits into these findings. The goal is to educate investors to confidently navigate the market’s intricacies, laying the groundwork for a potentially profitable and rewarding investment path guided by Elliott Wave theory concepts.

Criteria Used for Selection of Multibagger Small-cap Stocks

The Best 9 Stocks are chosen using Elliott Wave Theory, a predictive tool in financial markets, after thorough analysis based on specific criteria.

- The selection procedure is based on the concepts of wave theory, a technical analysis method that identifies patterns and trends in market charts. Using Elliott Wave Theory gives a more in-depth understanding of market cycles, revealing potential turning points and future price movements.

- Every stock in the best 9 multibaggers has gone through a lengthy corrective period. These corrective phases are crucial for market adjustments because they allow for the identification of potential entry locations once the correction phase is completed.

- The vast majority of the stocks have been considered undervalued, offering an opportunity for investors to enter the market at a low cost. This provides another layer of possible financial appreciation in the future.

- Following the corrective phase, each stock has entered a motivation phase, signaling the possibility of a protracted uptrend. The start of the motive phase acts as an important signal for investors, indicating that the stock is ready for strong momentum and possible growth.

- The study scrutinizes price movement, technical indicators, and chart patterns to assess if each stock is poised for a significant advance.

- According to Elliott Wave Theory, the selection process expects a significant movement in the shape of Wave 3.

Importance of Diversification in Investing

Diversification is a strategic investment method that helps identify the best multibagger stocks by spreading investments across multiple industries. This approach mitigates risk by distributing investments among various assets, lessening the impact of underperforming investments. It is vital to cope with uncertainties in financial markets and cyclical economic conditions.

The fact that diversification boosts portfolio returns by collecting gains from well-performing assets and also manages risk demonstrates its adaptability and comprehensive influence on investment strategies>

Diversification offers investors a wider range of market opportunities, reducing reliance on a specific market segment and allowing them to capitalize on opportunities across various sectors, mitigating concentration risks. It allows investors to align their portfolios with their individual financial goals, risk tolerance, and time horizons, ensuring a tailored investment strategy that aligns with their broader financial plan.

Benefits from Diverse Sectors

- Diversification helps in risk mitigation by spreading investments across different sectors and asset types, reducing the overall portfolio’s susceptibility to the negative impact of a single underperforming investment.

- Smooth out portfolio volatility by reducing the impact of extreme fluctuations in individual investments, making it crucial for investors to preserve capital and minimize market downturns’ impact.

- A risk management strategy, can enhance the potential for returns by capturing gains from well-performing assets and offsetting losses in other areas.

- Diversification offers a wider range of market opportunities, ensuring the portfolio’s performance is not overly reliant on a specific market segment’s performance.

- It enables investors to create a balanced portfolio that aligns with their financial goals, risk tolerance, and investment time horizon, reflecting their individual preferences and objectives.

- Diversification allows investors to adapt to dynamic market conditions by exposing them to various assets, a crucial factor for long-term success amidst uncertainties.

- Liquidity profiles help manage liquidity risk and provide a stable portfolio during market stress by combining liquid and less-liquid assets.

- Long-term wealth preservation is crucial for investors, and diversification helps prevent capital loss when a portfolio is concentrated on a few significant asset declines.

Portfolio Rebalancing

Portfolio rebalancing is a proactive strategy for managing risk and enhancing long-term gains in the 9 Best Multibagger Stocks. It allows investors to adapt to market dynamics and strategically deploy capital in line with the financial landscape’s conditions.

Portfolio rebalancing is a crucial strategy for investors in multibagger stocks, where the goal is to capitalize on price appreciation. This dynamic process ensures a balance between risk and reward, allowing investors to remain agile and responsive to the market’s changes. Portfolio rebalancing safeguards gains and positions the portfolio to capture future multibagger opportunities, aligning with the goal of maximizing returns in the competitive stock market. Thus, it is a strategic imperative for those investing in the ‘9 Best Multibagger Stocks to Buy.’

Where to Invest in Stock Market

Detailed analysis of best multibagger penny stocks

- Infrastructure sector

Stock 1 – Jaiprakash Associates Ltd

Jaiprakash Associates Ltd., established in 1979, is a diversified conglomerate in India, focusing on engineering, construction, and power generation across various segments such as construction, cement, hotel and hospitality, sports events, real estate, and investments. Jaiprakash Associates Ltd.’s future outlook depends on its strategic positioning across the construction, cement, hospitality, real estate, and power sectors. Investors should monitor developments and regulatory changes.

JPASSOCIAT CMP 18.10

Stock 2 – Madhucon Projects Ltd.

Madhucon Projects Limited, a prominent infrastructure company, is among the Best 9 Multibagger Stocks due to its commitment to quality construction and development. The company has played a significant role in shaping critical infrastructure, including roads, highways, bridges, and irrigation infrastructure.

MADHUCON CMP 5.95

- Manufacturing Sector

Stock 3 – NITCO Ltd

NITCO Ltd., a leading Indian flooring solutions provider, is among the Best 9 Multibagger Stocks due to its quality craftsmanship and innovation. With a diverse portfolio, including floor tiles and ceramic and vitrified tiles, NITCO excels in the construction and interior design industries. The company’s consistent financial performance, innovative product offerings, and potential for sustained growth make it a compelling opportunity for investors.

NITCO CMP 33.85

- Finance Sector

Stock 4 – Nagreeka Capital & Infrastructure Ltd

Nagreeka Capital & Infrastructure Ltd., a Mumbai-based NBFC, specializes in financial portfolio management and trading activities. Established in 1994, it invests in equity markets, private equity, mutual funds, real estate, and renewable energy, serving as a financial hub.

NAGREEK CMP 21.30

- Pharmaceutical sector

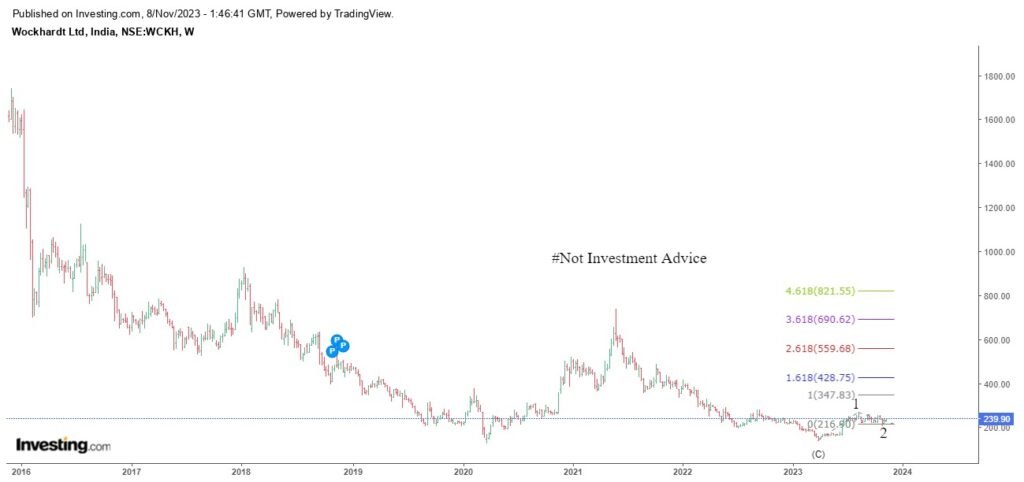

Stock 5 – Wockhardt Ltd

Wockhardt Ltd. is a leading pharmaceutical company focused on drug discovery, development, and manufacturing. With a diverse portfolio of pharmaceutical formulations, including complex generics, biosimilars, and innovative therapies, the company is a key player in addressing global healthcare needs. Wockhardt’s commitment to research, strategic collaborations, and a robust pipeline of potential blockbuster drugs make it a compelling opportunity for investors in the Best 9 Multibagger Stocks.

WOCKPHARMA CMP 239.90

- Energy sector

Stock 6 – Reliance Power

Reliance Power is a key player in India’s power generation sector, committed to energy innovation, sustainability, and nation-building. As part of the Reliance Group, RPOWER has developed and operated diverse projects, focusing on thermal, renewable, and cutting-edge technologies. With a focus on clean and green energy solutions and successful project execution, RPOWER offers investors a compelling avenue for long-term growth in the energy sector.

RPOWER CMP 20.70

- Power transmission and distribution sector

Stock 7 – Jyoti Structures Ltd.

An industry leader in electricity transmission and distribution, Jyoti Structures Limited is one of the top 9 multibagger stocks because of the impact it has had on the country’s infrastructure. The company focuses on designing, manufacturing, and installing power transmission towers, contributing to the expansion and fortification of power grids.

JYOTISTRUC CMP 13.15

- Telecommunications sector

Stock 8 – Kavveri Telecom Products Ltd.

Kavveri Telecom Products Limited is a leading provider of advanced telecom infrastructure solutions in the telecommunications sector. With a diverse portfolio of products, including antennas and RF components, it caters to evolving industry needs. As a multibagger prospect, Kavveri Telecom offers investors a strategic position in an industry crucial to global connectivity, with potential for significant value appreciation.

KAVVERITEL CMP 9.90

Stock 9 – Mahanagar Telephone Nigam Ltd.

Mahanagar Telephone Nigam Limited (MTNL) is a prominent telecommunications company in Delhi and Mumbai, providing reliable and innovative services like mobile, broadband, etc. With a strategic presence in key urban markets, MTNL is poised to capitalize on the evolving needs of a digitally connected society.

MTNL CMP 28.45

#All are weekly charts.

Rising Trends and Their Impact on Selected Stocks

Developmental trends and market dynamics dictate stock performance; the top nine multibaggers are examples of this. After enduring a protracted period of correction, these stocks have successfully navigated uncertainty and reassessed their valuations. As a result, these inexpensive assets are poised to reach new heights, signaling a significant shift in the market.

The multibagger stocks have successfully weathered a prolonged correction, offering investors a unique entry point for a long and promising rally. This aligns with Elliott Wave theory, where wave 1 in a lower degree signals a powerful upward rally. Investors can capitalize on the upward trajectory of multibagger stocks, leveraging potential gains as they enter a new phase of growth. The analysis of chart patterns and confirmation of wave 1 completion offer a bullish outlook on these stocks.

The Best 9 Multibaggers Stocks are resilient and potential future market outperformers due to their convergence of technical indicators and unique valuation proposition. Investors can benefit from strategically aligning with these carefully chosen stocks, ensuring significant rewards in navigating rising trends.

Portfolio Strategy

Allocation Recommendations

Diversification is a key principle in creating a robust portfolio strategy for investors seeking maximum returns with the best nine multibagger stocks, mitigating risk, and optimizing gains.

- By spreading your money around, you can spread your risk and benefit from other stocks’ performance. This technique is especially crucial when dealing with investments like the stock market, which are inherently unpredictable.

- Diversifying across these stocks allows investors to capture a wide range of market trends and possible catalysts. It prepares the portfolio to benefit from the potential expansion of various sectors and businesses.

- Investors establish a balance between prospective returns and potential losses by spreading their assets among a diverse range of stocks.

- A well-diversified portfolio helps maintain long-term stability. It protects against unforeseeable occurrences that may have a disproportionate impact on a certain stock or sector.

Regular Tracking and Adjustment of the Best Multibagger Stocks for Long Term

The Best 9 Multibagger Stocks to Buy strategy relies on regular tracking and adjustment to ensure success. Investors must monitor selected stocks, key indicators, market trends, and news to make informed decisions. Regular adjustment allows portfolios to be adjusted in response to changing circumstances, such as rebalancing fund allocation, adjusting risk exposure, or seizing new opportunities. This dynamic approach maximizes the potential for long-term success in the investment strategy.

We expect the price chart to show higher positions for the best 9 multibagger stocks. With reversals or lower-risk positions, investors still need to be alert and take initiative. Implementing stop-loss measures and being prepared to adjust strategies can protect against potential losses.

Exit Strategies for Stocks

When and Why to Sell?

The Best 9 Multibagger Stocks to Buy emphasizes the importance of a well-crafted exit strategy, which helps investors protect gains, manage risks, and remain agile in response to market fluctuations. One notable exit strategy is the Darvas Box Theory, which involves keeping a stop-loss at the higher low position.

The Darvas strategy is a strategic approach where investors set a stop-loss level based on a stock’s higher low position on the price chart. This is done to protect profits and limit losses in case of a potential reversal or weakening of the stock’s upward momentum.

The Darvas principle-based exit strategy enhances the resilience of the Best 9 Multibagger Stocks investment approach, recognizing market fluctuations and the importance of strategic exit for safeguarding and optimizing returns.

Summary

The investment strategy focuses on discovering the best 9 multibagger stocks to buy through a holistic approach involving research, diversification, and dynamic portfolio management. Stocks chosen are chosen based on Elliott Wave Theory and market analysis, identifying those that have experienced a long correction phase. Diversification across various sectors manages risk and capitalizes on diverse market opportunities. Portfolio rebalancing ensures allocations stay attuned to market dynamics, enhancing the potential for long-term success.

The strategy for the best 9 multibagger stocks to buy is a dynamic and strategic approach rooted in research, diversified in allocation, and adaptable to market shifts. It involves regular tracking and adjustments to respond to emerging trends and maximize growth potential. Exit strategies, like the Darvas strategy, add risk management by strategically placing stop-losses at higher low positions. This aims to empower investors to navigate the financial landscape successfully.

Emphasis on Informed Decision Making and Risk Management

In financial markets, informed decision-making and risk management are crucial for successful investing. Understanding market dynamics, economic indicators, and investment factors is essential. Thorough research on stocks, using fundamental and technical analysis, and staying updated on industry developments and news are essential for timely and insightful decisions.

Implementing robust risk management strategies is crucial for investors. Assess risk tolerance, set risk-reward parameters, diversify portfolios, and use risk mitigation tools like stop-loss orders. Regularly review and adjust portfolios based on risk tolerance and market conditions. This informed decision-making and meticulous risk management position investors for long-term success and confidence in market uncertainties.

Final Thoughts

In 2024, investors should exercise flexibility and intelligence, closely monitoring the nine penny stocks identified by Elliott Wave research as potential multibaggers. However, in order to deal with the market’s unknowns, they need to keep up with news about the economy, their sector, and world events.

The text emphasizes the importance of diversification, informed decision-making, and risk management in portfolio management. It advises diversifying to spread risk and enhance resilience and regularly reassessing and adapting strategies to market conditions.

In 2024, success in investing relies on discipline and patience. A well-balanced portfolio can weather uncertainties and position itself for long-term growth. Stay informed, adapt your strategy, and stay updated on the economic landscape and selected stocks’ performance. A year of informed investing and risk management is essential.

FAQ

What should I consider when investing in these stocks?

To invest in stocks, use a holistic approach that balances risk and rewards. Understand Elliott Wave theory, conduct thorough research on companies, monitor market conditions, diversify portfolios, and regularly monitor technical indicators. Stay informed about market trends and consider your risk tolerance, investment horizon, and financial objectives for informed decisions.

How can I effectively manage my portfolio?

To manage your portfolio effectively, establish clear investment goals, diversify holdings, regularly review and rebalance, stay informed about economic trends, use risk management tools, reassess your investment thesis, and revisit financial goals. This ensures alignment with your investment strategy, adapts to market conditions, and ensures your portfolio remains in sync with your objectives.

Disclaimer

This article is provided for informational purposes only and does not offer financial advice. Trading and investing involve risk, and past performance is not a guarantee of future outcomes. Before making investment decisions, readers should conduct their own research and consider their individual circumstances. The author and platform are not responsible for any financial losses or damages resulting from the use of this information. Get personalized advice from a trained financial counselor.

Chart Source: investing.com

Leave a Reply