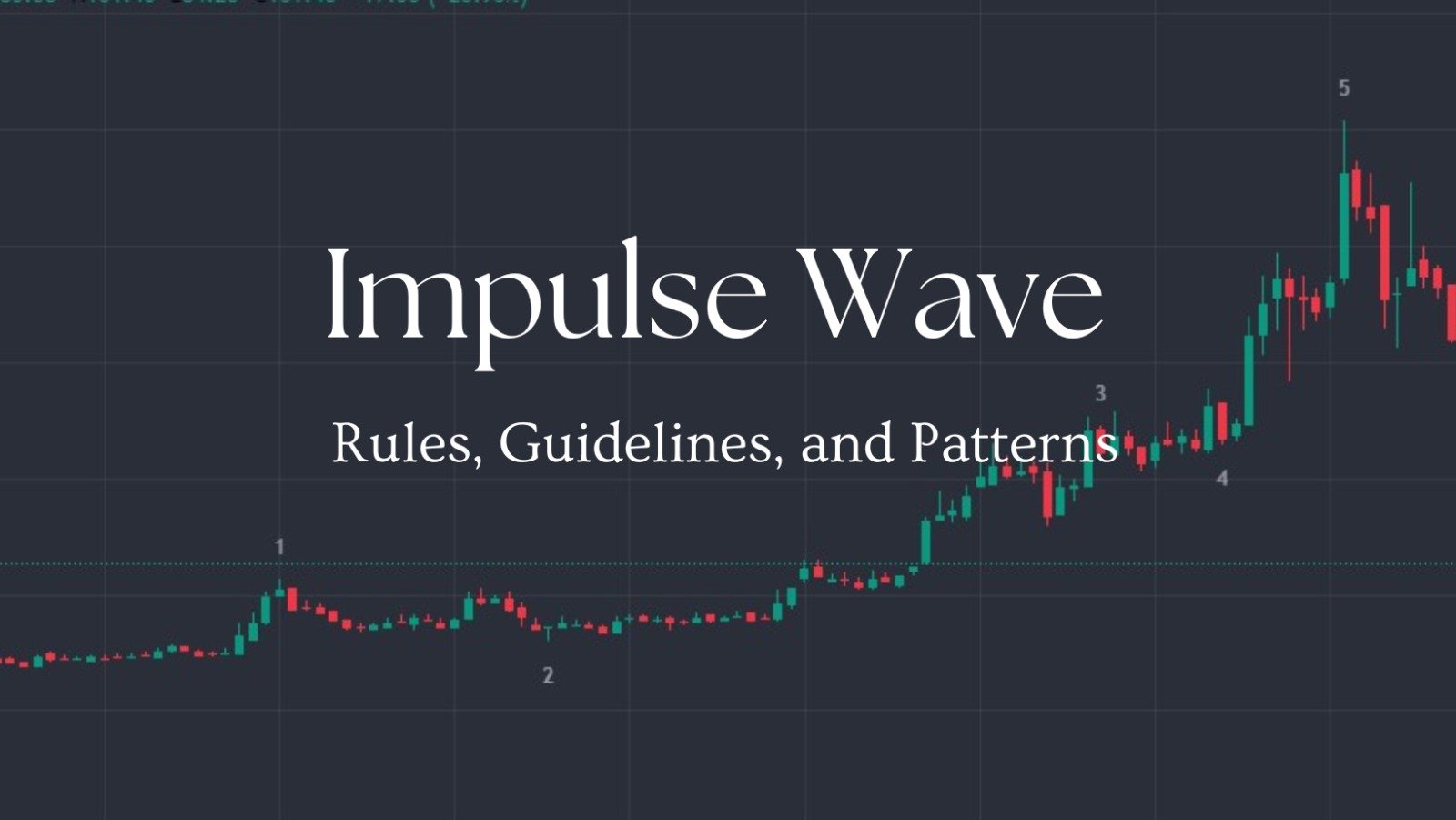

Impulse Wave

In financial markets, impulse wave patterns are key indicators of price movements aligning with trends. Understanding these waves helps decode market dynamics. Understanding these waves helps decode market dynamics. This wave can signal upward surges or downward shifts. Join us as we uncover the complexities of these waves, investigating the laws, guidelines, and underlying structures in order to navigate the interesting trading scene.

in short

What is an Impulse Wave Pattern?

An impulse wave pattern is a unique structure noticed in financial markets that represents a strong and directional price movement in the context of technical analysis and Elliott Wave Theory. This pattern is part of Elliott Wave Theory, which seeks to discover and comprehend recurring wave patterns in market price charts.

Key characteristics of an Impulse Wave Pattern

- Impulse waves follow the prevailing trend upward or downward and indicate a strong and prolonged price movement.

- An impulse wave is composed of five sub-waves: 1, 3, and 5 move in the direction of the trend, while waves 2 and 4 represent corrections or retracement.

- Wave 3 in an impulse wave will be at least 161.8% of the length of Wave 1.

- Wave 3 in the impulse pattern is typically the longest and most forceful.

- If wave 1 is diagonal within an impulse, it is probable that wave 3 will be extended.

- Waves 2 and 4 are character, duration, and structural alternations.

- Wave 1 is typically divided into an impulse or a diagonal.

- Wave 3 is always divided into an impulse.

- Wave 5 is typically divided into an impulse or a diagonal.

- Wave 2 can always be divided into zigzag, flat, or combination corrections.

- Wave 4 is a correction technique that typically involves subdividing into zigzag, flat, triangle, or combination corrections.

- Wave 3 is never the shortest wave.

- Wave 4 does not extend beyond the conclusion of wave 1.

- The waves 1, 3, and 5 are never all extended.

Impulse Waves rule

Impulse rule 1: Wave 2 never exceeds the starting point of Wave 1

Impulse rule 2: Wave 3 can never be the shortest wave

Impulse rule 3: Wave 4 can never overlap Wave 1

Impulse rule 4: Waves 4 and 2 often exhibit alternation in their characteristics

How to identify impulse wave pattern?

Identifying an impulse wave pattern entails analyzing the market‘s overall trend, noting strong and sharp movements, and verifying adherence to specified rules.

Here’s a step-by-step guide:

1. Larger Trend

Typically, impulse waves develop along the direction of the larger trend. Begin by identifying if the overall trend is rising or declining.

2. Strong and Sharp Movements

Impulse waves are distinguished by rapid and decisive price movements. Look for areas of the chart where prices shift quickly and dramatically.

3. 5 Wave movements

Identify strong movements and monitor Wave 5, which often culminates in a final push in the direction of the trend.

4. Verify Impulse rules

The impulse wave must adhere to fundamental rules, including the structure of five waves (numbered 1 through 5) and their unique characteristics.

Profitable Strategies of Elliott Wave Trading #Profit Hacking Guide

What are the different types of Impulsive Waves?

Elliott Wave Theory categorizes impulsive waves into two main types: Normal Impulse Waves and Extended Impulse Waves.

1. Normal Impulse Waves

Structure: A normal impulse wave follows the standard five-wave pattern, labeled 1 through 5.

Characteristics: Wave 3 is the strongest.

2. Extended Impulse Waves

Structure: An extended impulse wave also consists of five waves (1 through 5), but one of these waves experiences a more prolonged and stronger price movement.

The overall structure of an extended wave maintains clarity by ensuring that all sub-waves (1, 2, 3, 4, and 5) remain distinct and visible.

Characteristics: One of waves 1, 3, or 5 will be extended in an Impulse Wave.

Wave 3 typically exceeds normal impulse length, often with smaller or less significant corrections in Waves 2 and 4.

Difference between Diagonal and Impulse

1. Impulse Waves

- Structure: Impulse waves consist of five sub-waves: 1, 3, 4, and 5, which move in the direction of the trend; and 2, and 4, which represent corrections.

- Characteristics: Wave 3 is typically the longest and strongest wave. One of waves 1, 3, or 5 will be extended.

- Direction: Impulse waves follow the prevailing trend and signify a strong and sustained price movement.

2. Diagonal Waves (Ending Diagonals and Leading Diagonals)

- Structure: Diagonal waves, often known as wedge patterns, are made up of five sub-waves with a more converging structure. Unlike impulse waves, diagonal waves often have overlapping sub-waves.

- Characteristics: Diagonals are patterns with converging trendlines, indicating a decrease in the current trend.

- Direction: Leading Diagonals align with the larger trend, while Ending Diagonals oppose it.

Final thoughts

Understanding impulse waves is a powerful tool for mastering market dynamics. It helps traders identify and navigate strong trends, providing a framework for anticipating and capitalizing on market movements. However, it’s essential to recognize the subjectivity and potential challenges involved. A holistic approach combining technical analysis, risk management, and adaptability to changing market conditions is crucial for a more informed and effective trading strategy. This approach is a cornerstone of Elliott Wave Theory.

FAQ

Can the Impulse Wave Pattern predict the future direction of the market?

While some traders claim that anticipating the Impulse Wave Pattern is as simple as detecting corrections and sub-wave 1, it’s important to remember that projecting market movements always contains inherent uncertainties. The Elliott Wave Theory gives a framework for interpreting repeating patterns based on investor psychology, and identifying corrections can be an important component of trend analysis. Successful prediction, on the other hand, necessitates a complete methodology that takes into account multiple market aspects, risk management, and responding to changing situations. The subjective nature of Elliott Wave analysis, as well as the possibility of interpretation variations among analysts, necessitate traders exercising prudence and supplementing their tactics with additional tools and analyses.

What are the challenges of using the Impulse Wave Pattern in financial analysis?

Using the Impulse Wave Pattern in financial analysis poses challenges due to its inherent subjectivity and complexity. The theory’s reliance on subjective interpretation, potential overlaps between waves, and the complexity of identifying patterns in real-time market conditions make accurate application difficult. Retrospective clarity, market noise, a lack of consensus in the financial community, and the theory’s static nature in adapting to changing market conditions contribute to the challenges. Professionals find value in Elliott Wave Theory; it is crucial to approach it with caution, complementing its insights with other analytical tools and risk management strategies.

Chart Source: tradingview.com

Disclaimer

This article is provided for informational purposes only and does not offer financial advice. Trading and investing involve risk, and past performance is not a guarantee of future outcomes. Before making investment decisions, readers should conduct their own research and consider their individual circumstances. The author and platform are not responsible for any financial losses or damages resulting from the use of this information. Get personalized advice from a trained financial counselor.