Wave 3 is a significant phase in Elliott Wave Theory, characterized by swift and robust momentum. It is crucial for traders and investors to understand its characteristics and navigate trades during this phase. This article delves into the personality of Wave 3 through the lens of price action, exploring essential trading strategies tailored for this influential wave. It aims to reveal nuanced techniques for effective trading and investment decisions in the charted landscapes. Understanding Wave 3 is essential for traders and investors to navigate the market effectively.

Significance of 3rd wave in Elliott Wave

Third waves of price movement can be unpredictable and powerful, requiring traders to be patient and execute stop-loss orders. In the end, chaos may ensue, with the market interpreting the news as a sign of market strength. It’s crucial to be prepared for these unpredictable market conditions.

Here are key aspects highlighting the significance of the 3rd wave:

1. Strong Momentum: The 3rd wave is distinguished by a strong and prolonged directional movement in the main trend. It has the most powerful upward or downward speed when compared to other waves.

2. Largest Price Movement: In many cases, wave 3 covers the most distance in terms of price movement within the Elliott Wave sequence. This makes it an important time for traders and investors to profit from significant price moves.

3. Confirms Trend Direction: The formation of wave 3 confirms the overall direction of the market trend. Its strength usually confirms the impression that a substantial trend is underway, providing traders with useful information for decision-making.

4. Opportunity for Substantial Profits: Because of its prolonged length and powerful trend, wave 3 offers significant profit chances for those who can precisely recognize and ride it. Traders frequently seek entry chances during the early stages of the third wave.

5. Challenging to Identify Early: While wave 3 is a key element of Elliott Wave analysis, identifying it in its early stages can be challenging. However, successful recognition and positioning during the 3rd wave can lead to profitable trades.

6. Followed by a Corrective Wave: Following the end of wave 3, a corrective wave (wave 4) is usually followed. Understanding the Wave 4 features is critical for traders expecting future retracements or consolidation periods.

The 3rd wave is the foundation of Elliott Wave cycles, presenting significant price fluctuations and providing traders and investors with an excellent opportunity to capitalize on prevailing trends.

What are the wave 3 rules?

Wave 3 is termed in Elliott Wave Theory as the extended wave and is known for its intensity and importance in a price trend. While the theory is complex and wave identification requires a great deal of skill and study, there are certain broad standards and laws related to Wave 3:

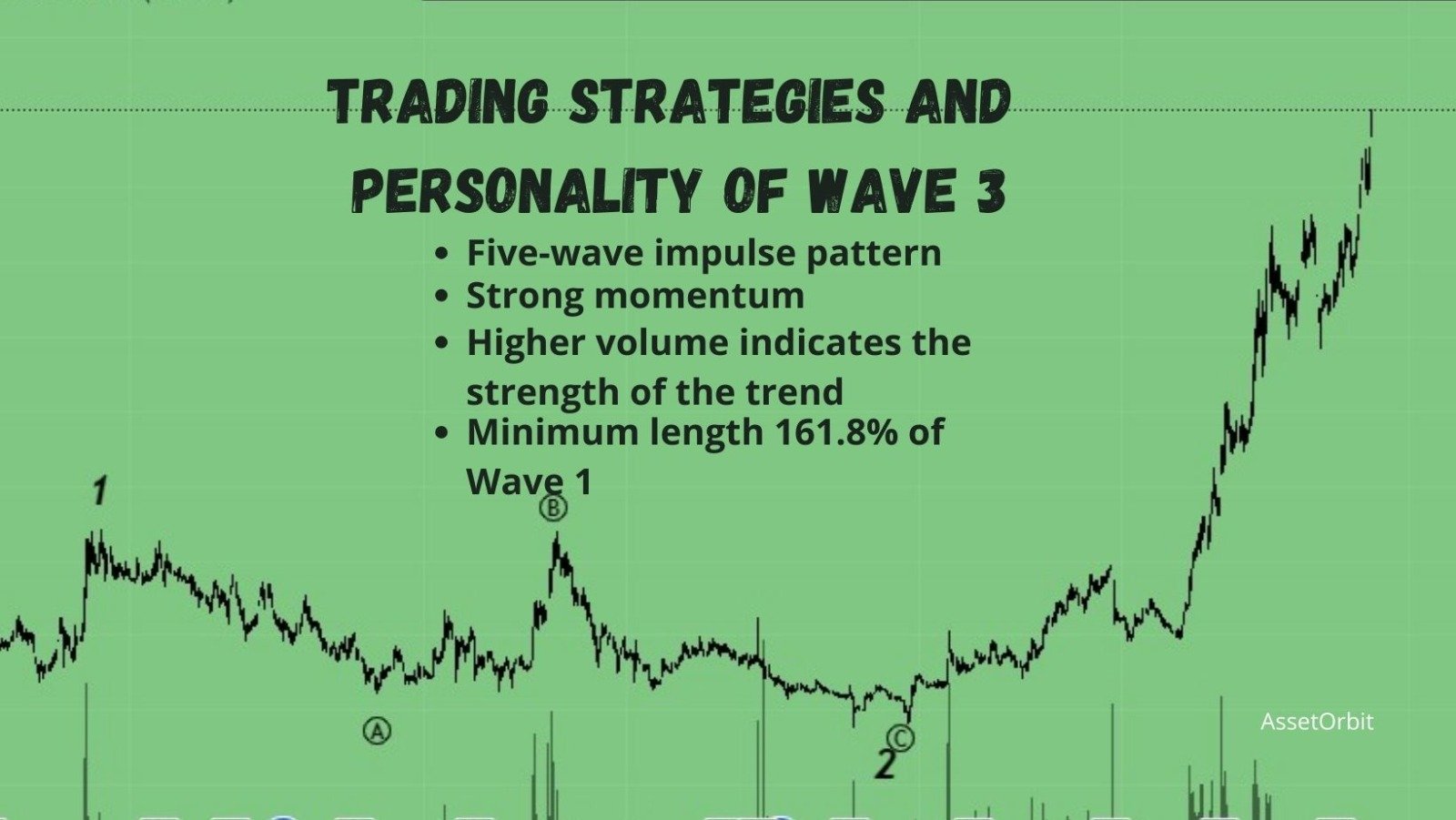

- Wave 3 is a wave in the five-wave impulse pattern, indicating the strongest price movement in the direction of the overall trend, as part of the prevailing trend.

- In many cases, wave 3 is the longest wave in an impulse sequence, characterized by its lengthening and being labeled as an extended wave.

- Elliott Wave Theory states that the highs of Wave 3 do not overlap with the highs of Wave 1 in an upward trend and vice versa, a fundamental rule.

- Wave 3 is characterized by strong momentum and rapid price movement in the direction of the prevailing trend.

Wave 3 Rules - Wave 3’s higher volume indicates the strength of the trend, as it tends to be higher than other waves in the sequence.

- Wave 3’s length often demonstrates Fibonacci relationships with either Wave 1 or Wave 5, as seen in the example of 161.8% or 261.8% of Wave 1’s length.

How do you calculate Elliott Wave 3?

The journey of Elliott Wave analysis, especially in the context of Wave 3, requires a deep understanding of calculation methodologies. This article explores the intricacies of computing Elliott Wave 3, a pivotal wave with extended momentum and a defining influence on market trends. It delves into the methodologies and indicators that enable traders to decipher and calculate the length, strength, and dynamics of Wave 3. The technical intricacies underscore successful trading strategies within the 3rd Wave terrain.

What is the target of wave 3 fib?

Understanding the complicated nature of Elliott Wave Theory, our dive into 3rd Wave Trading Strategies takes a closer look at the sophisticated concept of setting targets using Fibonacci levels. Wave 3’s minimum length is frequently 161.8% of Wave 1 in the context of Wave 3’s distinct personality. If the length falls below this threshold, doubts about the Wave 3 designation may arise. Setting a target at the 161.8% Fibonacci level becomes a simple technique of verification in such instances.

Furthermore, using sub-wave computations within the 5-3-5-3-5 wave structure enables exact target identification. Because Wave 3 is an impulsive wave, the 5-3-5-3-5 wave count is helpful in locating targets.

Trading strategies in 3rd wave

How can you know that the third wave has started?

- The third wave of trading is characterized by sudden and swift price increases, with the third wave being steeper than the first wave and typically accompanied by an increase in volume.

- Maximize trading opportunities by capitalizing on the robust and sustained momentum of the 3rd wave.

- Utilize Fibonacci retracement and extension levels to identify potential targets and confirm the strength of the 3rd wave.

Fibonacci Extension - The wave count can be confirmed by applying the 5-3-5-3-5 structure, ensuring the coherence of the Elliott Wave sequence.

- The objective is to scrutinize the volume patterns closely to assess the strength and legitimacy of the 3rd wave’s price movements.

- The emphasis is on tailoring trading techniques to the dynamic nature of the third wave, thereby maximizing trading decisions in response to its distinct characteristics.

Key takeaways

- The third wave cannot be the shortest of the three impulse waves.

- Three of the five impulse waves, namely waves 1, 3, and 5, are in the direction of the trend. Wave 3 is the longest and strongest wave.

- According to Elliott, at least one of the three impulses in a five-wave impulse move is normally an extended wave that travels more than usual. The most common time for an extension is during the third wave.

- In a normal third wave, it is common for impulse waves to tend to equality, such as waves 1 and 3, or waves 3 and 5, or waves 1 and 5. This relationship between sub-waves is normal.

- If wave three surpasses the equality measure of wave 1, the next target is likely to be 123.6% of wave 1, or 161.8% of wave 1. As long as wave 3 doesn’t exceed 161.8% of wave 1, it’s considered a normal third wave.

- During a third wave, prices often gap due to stop-loss orders and increased awareness of price evasion. Volume spikes also occur.

Frequently Asked Questions(FAQs)

1. Is wave 3 longer than wave 5?

Yes, in Elliott Wave Theory, it is characteristic for Wave 3 to be longer than Wave 5 within an impulse sequence. Wave 3 is frequently the longest and strongest wave, with great momentum and a significant price change. Wave 3’s prolongation adds to its reputation as the driving force behind a trend. While both Wave 3 and Wave 5 are important in defining market trends, the extended length of Wave 3 frequently results in it outpacing Wave 5 in terms of distance traveled. This pattern is crucial for traders and analysts who use Elliott Wave principles to understand and forecast market movements.

2. What is the minimum target of wave 3?

The minimum target of Wave 3′ in Elliott Wave Theory can be calculated as 161.8% of the length of Wave 1. This Fibonacci extension level is an important reference point for traders and analysts when determining Wave 3’s probable reach. If the length of Wave 3′ falls below this minimum level, the legitimacy of its designation as Wave 3′ may be called into question. As a consequence, setting the target at 161.8% Fibonacci gives a clear standard for confirming and analyzing the unfolding wave structure.

3. When wave 3 is extended?

In Elliott Wave Theory, Wave 3 is termed extended when it exceeds 161.8% of the length of Wave 1 and goes beyond the following levels, approaching or exceeding higher Fibonacci extension levels. In such cases, Wave 3 can be identified as an extended wave, indicating a strong and lengthy period of price movement. This happens when the momentum behind Wave 3 is extremely high, resulting in a more pronounced and powerful trend that extends beyond the conventional boundaries of an impulse wave. Traders frequently see protracted Wave 3s as important possibilities for strategic market participation.

Conclusion

Finally, the mystique surrounding Elliott Wave Theory may be seen even in basic numbers, remembering Nikola Tesla’s interest in the number 3. Elliott Wave 3 appears as a crucial dilemma in market dynamics, much like the fascination interred in the fundamental characteristics of the number 3. Delving into the complexities of Elliott Wave analysis reveals a common excitement among traders and investors, with Wave 3 standing out as a sought-after wave. The market, like the underlying patterns of numbers, continues to enchant individuals who explore Elliott Waves, with Wave 3 playing a vital role in this fascinating journey.

Chart Source: tradingview.com

Disclaimer

This article is provided for informational purposes only and does not offer financial advice. Trading and investing involve risk, and past performance is not a guarantee of future outcomes. Before making investment decisions, readers should conduct their own research and consider their individual circumstances. The author and platform are not responsible for any financial losses or damages resulting from the use of this information. Get personalized advice from a trained financial counselor.