Before taking any market action, any investor or trader must ask themselves a basic question: Have I identified Wave 1? If the answer is yes, the path to planning investments or trades becomes much clearer.

Understanding the patterns and characteristics of Wave 1 is so crucial. Here, we’ll examine Wave 1 of the Elliott Wave and discuss its characteristics, rules, and patterns. If you want to learn how to trade and invest more easily, stay tuned for some important tips.

In Short

What is the Importance of Wave 1?

In the Elliott Wave Principle (EWP), Wave 1 is considered important for several reasons:

1. Initial Trend: At the conclusion of a stabilizing or corrective phase, a new trend begins with Wave 1, which signifies the beginning of a motive phase.

2. Price Movement: To set the stage for the bigger trend, Wave 1 usually displays robust momentum and substantial price movement.

3. Foundation: The first wave establishes the groundwork for the following waves, which in turn affect the trend’s structure and direction.

4. Confirmation: The successful completion of Wave 1 confirms the reversal of the previous trend and the start of a new direction.

5. Measurement: Wave 1 makes it simple to gauge the potential size of the following wave (Wave 3).

6. Emphasizing Trader: The potential rewards for those who can correctly predict and position themselves during this phase make the first wave the most talked about in the trading world.

Characteristics of Wave 1

Identifying a motive phase is crucial for any trader or investor. How do you identify Wave 1? Investigate to learn the fundamentals of detecting Wave 1 and improve your ability to make clever market entries.

Wave 1: Start at a Low or High Market

If the market is in a bullish or bearish trend, Wave 1 will begin on a small scale at the market’s important low or high, respectively. It signifies the beginning of a new market cycle, either a rise or a fall, and it occurs after a corrective phase. If the market is bullish, Wave 1 will begin immediately after a large correction or dip and might signal the start of an upward trend. Bear markets reverse the process, starting at a significant high.

Pattern 1 of Waves: Impulse and Diagonal

Wave 1’s resemblance to an impulse wave, a powerful directional motion that heralds the beginning of a new trend, is a defining characteristic. But it’s not always a clear or simple formation. Be aware that Wave 1 might take on the appearance of a wedge or diagonal triangle pattern on occasion.

Role of Market Divergence

In many cases, market divergence is an early warning indication of Wave 1. Divergence occurs when asset prices deviate from the trends of technical indicators such as momentum and volume. This divergence, which is preparing the market for Wave 1, allows traders to observe that the current trend is losing momentum.

Wave 1 in Trading and Investing

To effectively time your market entries, you must be able to recognize Wave 1. Buying into Wave 1 of a trend in trading lets you ride it out, and in investing, it may be the best time to buy a growth asset.

Wave 1 Rules: The Foundation for Market Analysis

Elliott Wave theory provides traders and investors with particular guidelines for Wave 1 that enhance their ability to make forecasts. A few examples are:

- Once the prior trend’s corrective phase ends, wave 1 can be considered to have begun.

- The ability to count 1-2-3-4-5 usually indicates the completion of a short Wave 1 in a new cycle.

How to Identify Wave 1?

The identification of Wave 1 in Elliott Wave theory requires careful observation and analysis, focusing on key aspects.

Rule 1. Strong Impulse Movement

Wave 1 typically shows strong, impulsive price movement towards emerging trends, so be prepared for significant price shifts.

Rule 2. Leading Diagonal Patterns

Wave 1 frequently exhibits leading diagonal patterns, characterized by distinct series of highs and lows in an uptrend or lower highs and lows in a downtrend.

Rule 3. Volume Confirmation

During Wave 1, trading volumes typically increase, indicating the strength of the emerging trend’s development.

Rule 4. Clear Price Structure

Wave 1 should exhibit a distinct and identifiable price structure, marking a new onset in the overall market trend.

Traders can improve Wave 1 identification and early market trend insights by combining elements, practicing, and observing price charts patterns, enhancing their proficiency.

Patterns of Wave 1

Wave 1 in Elliott Wave theory is a series of common patterns that traders often observe.

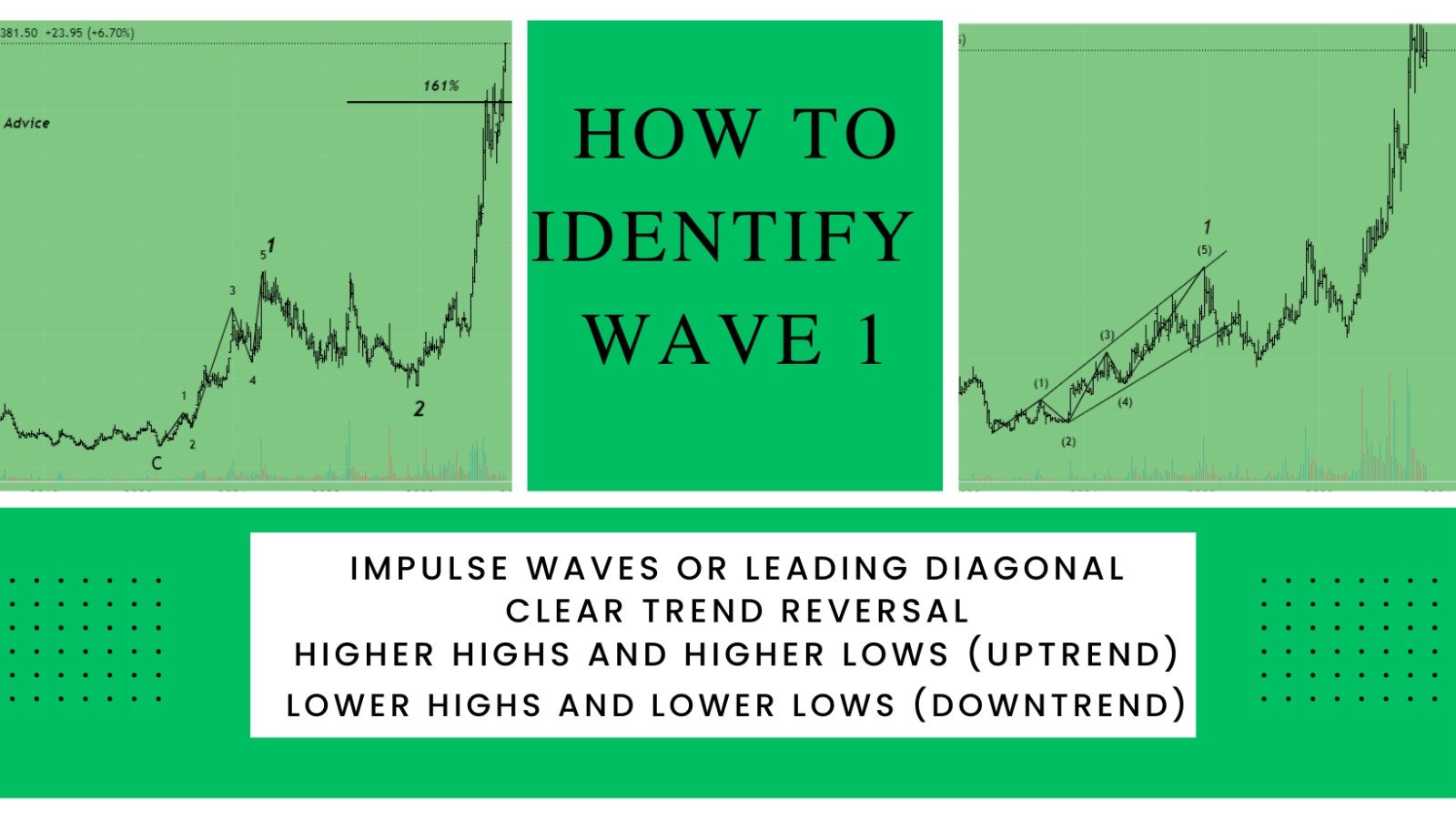

Pattern 1. Impulse Waves

Wave 1 typically exhibits a robust impulse movement in the direction of the emerging trend, which can consist of five smaller waves.

Pattern 2. Leading Diagonal

Often, wave 1 is characterized by a leading diagonal pattern consisting of overlapping waves that form a distinctive diagonal shape.

Clear Trend Reversal

Wave 1 marks the beginning of a new trend, showcasing a clear reversal from the previous market direction.

Higher Highs and Higher Lows (Uptrend)

Wave 1 in an uptrend exhibits higher highs and higher lows, indicating a bullish sentiment.

Lower Highs and Lower Lows (Downtrend)

Wave 1 in a downtrend exhibits lower highs and lower lows, indicating a bearish sentiment.

Keep Stop-loss with Wave 1

The strategy used to place a stop-loss order to just keep the starting point of the five-wave move is based on the Elliott Wave principle that wave 2 should not go below the beginning of wave 1. Wave 2 is a corrective wave that follows the first impulse/diagonal wave (wave 1).

1. Identifying the Impulse Wave (Wave 1)

The five-wave move refers to the initial impulse/diagonal wave, which can either be an upward or downward movement in an asset‘s price.

2. Wave 2 as a Corrective Wave

The market typically experiences a corrective wave, labeled as wave 2, after completing the five-wave impulse, which represents a temporary counter-trend movement.

3. Protective Measure with Stop-Loss

Placing a stop-loss order to keep the five-wave move’s starting point is a risk management approach. It is intended to safeguard traders from potential losses.

4. Elliott Wave Principle’s Rule

The Elliott Wave Principle states that wave 2 should not retrace more than 100% of wave 1, and traders set a stop-loss just at the starting point of wave 1 if the market invalidates the expected wave pattern.

Final Thoughts

In conclusion, learning to identify Elliott Wave 1 is a vital skill for traders and investors. Understanding the characteristics, rules, and patterns associated with Wave 1 can provide a more comprehensive view of market dynamics. This information enables individuals to manage the intricacies of financial markets, make informed investment decisions, and plan their transactions strategically. As we uncover the complexities of Wave 1, we discover a powerful tool that improves our capacity to understand and react to market movements effectively.

FAQs

What counts as 1 wave?

In Elliott Wave theory, one wave reflects a major directional movement in the price of an item. It is made up of a series of smaller price changes that all point in the same direction and represent the broader trend. The theory behind the idea is that market movements follow a repeated pattern of five waves in the direction of the main trend (impulse waves) and three periods in the opposite direction (corrective waves). Identifying and comprehending these waves is crucial for traders and investors to make informed decisions and efficiently manage market patterns.

Disclaimer

This article is provided for informational purposes only and does not offer financial advice. Trading and investing involve risk, and past performance is not a guarantee of future outcomes. Before making investment decisions, readers should conduct their own research and consider their individual circumstances. The author and platform are not responsible for any financial losses or damages resulting from the use of this information. Get personalized advice from a trained financial counselor.