Alternation in the Elliott Wave

The term alternation in the Elliott Wave refers to the hidden nature of its patterns. Alternation consists mostly of two corrective waves, Wave 2 and Wave 4. Have you ever noticed? Observing alternations becomes apparent quickly. Look at the chart once more. Within the same sequence, you will note that two subsequent corrective waves do not unfold in the same way. Based on the area covered in terms of pattern, duration, and pricing, the two waves have different characteristics.

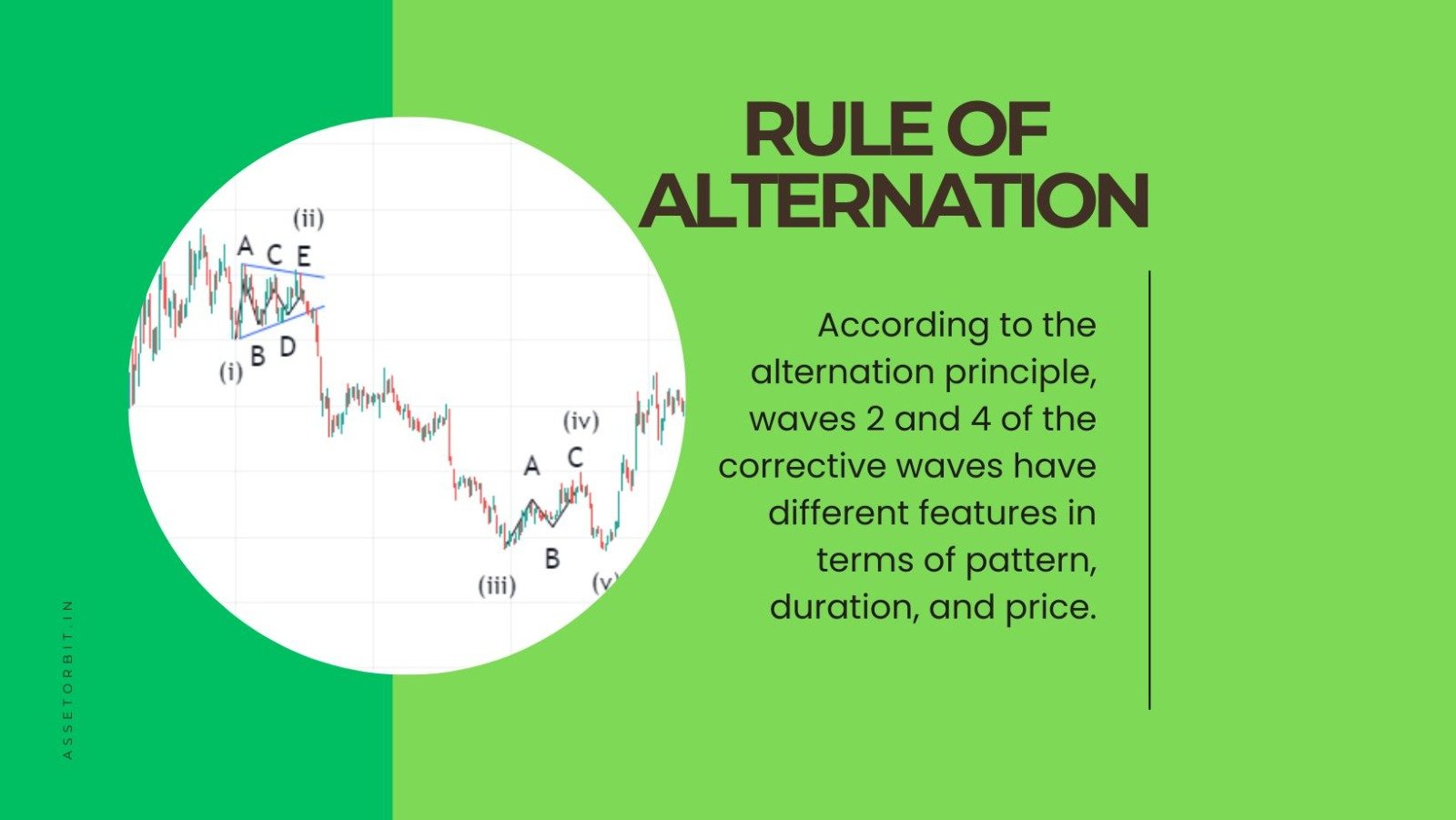

Rule of Alternation

In Elliott Wave Theory, alternation refers to the idea that corrective waves, particularly Waves 2 and 4, have opposing characteristics. If Wave 2 is a straightforward correction, Wave 4 will most likely be more complex, and vice versa. Imagine it as a balancing act. If Wave 2 goes deep into retracing prices, Wave 4 will most likely cover less territory. On the other side, if Wave 2 is a short correction, Wave 4 may cover a wider price range. Timing is also important; if Wave 2 is slow, Wave 4 may be quick, and vice versa. This alternation principle enables traders to forecast and adjust to changing market patterns.

Wave 2 #Characteristics, Patterns and Rules

Wave 2 in Elliott Wave theory often cautions traders because, following this correction phase, the market is frequently preparing for major movements. Many professionals prefer to enter the market during this correction period, when the wave count is accurate. The correction’s duration varies, but it normally falls within a 50% retracement of Wave 1. During this phase, zigzags and flats are the most common patterns. Traders enter based on either the natural pattern or a Fibonacci retracement of 61% to 78%. It is important to understand that Wave 2 will never exceed Wave 1’s beginning position. This insight sets it apart from the preceding waves, especially Wave 2 in sequence.

How much does wave 2 retrace?

Wave 2 retraces a significant portion of Wave 1, usually around 50% but varying from 38.2% to 61.8%. This retracement is viewed as a corrective measure preceding the next significant price movement. It’s crucial to keep in mind that the precise percentage may change and that the context and specific market circumstances can have an impact on how much of a retracement an asset or instrument experiences. Here, traders often use Fibonacci retracement levels to pinpoint probable reversal points.

Rule of wave 4 retracement

Wave 4 usually retraces 38 to 50 percent of Wave 3. During this stage, complex corrections are frequently observed. Moreover, Wave 4 continues an alternation with Wave 2. This rule provides insight into the likely characteristics of Wave 4 in relation to Wave 2. If Wave 2 is zigzag, Wave 4 could use a different corrective pattern, such as a flat, triangle, or complex correction. It is important to note that this guideline takes into account not only patterns but also time duration and price distance in order to provide a full analysis of potential Wave 4 movements.

How far can wave 4 retrace?

Have you ever observed a chart from a distance and seen a complex correction in a specific area of the trending market? The price could fluctuate for some time within a specific range. Wave 4 is often hidden behind this complex correction. Recognizing this complexity makes recognizing Wave 4 easier, especially when calculating the proportion with respect to Wave 3. In such circumstances, Wave 4 may retrace 38–50% of Wave 3, signifying a probable retracement zone.

Final thought

Finally, the concept of alternation can be used to better understand market corrections. The corrections follow motive waves; recognizing alternations helps traders make intelligent entry decisions. Alteration improves the clarity of corrections, resulting in a more strategic and effective trading approach, allowing for smoother entries and better navigation through market volatility.

FAQs

Can wave 2 be a flat?

Yes, Wave 2 may take the form of a flat correction. Flat corrections are identified by a three-wave pattern (A-B-C). In the case of Wave 2, this means that after the first impulsive Wave 1, the corrective Wave 2 can develop as a flat, with three sub-waves: an initial downward wave (A), a corrective upward wave (B), and another downward wave (C). This demonstrates the diversity in corrective patterns that Wave 2 might exhibit under the Elliott Wave theory.

Can wave 2 go below wave 1?

Wave 2 cannot go beyond the starting point of Wave 1. If such a scenario is observed, it is not considered a valid count for Wave 2. In other words, during an uptrend, Wave 2 cannot fall below Wave 1’s level, and during a downtrend, it cannot rise above Wave 1’s peak. This guideline helps traders find and confirm precise wave counts within the market trend while maintaining the integrity of Elliott wave analysis.

Disclaimer

This article is provided for informational purposes only and does not offer financial advice. Trading and investing involve risk, and past performance is not a guarantee of future outcomes. Before making investment decisions, readers should conduct their own research and consider their individual circumstances. The author and platform are not responsible for any financial losses or damages resulting from the use of this information. Get personalized advice from a trained financial counselor.